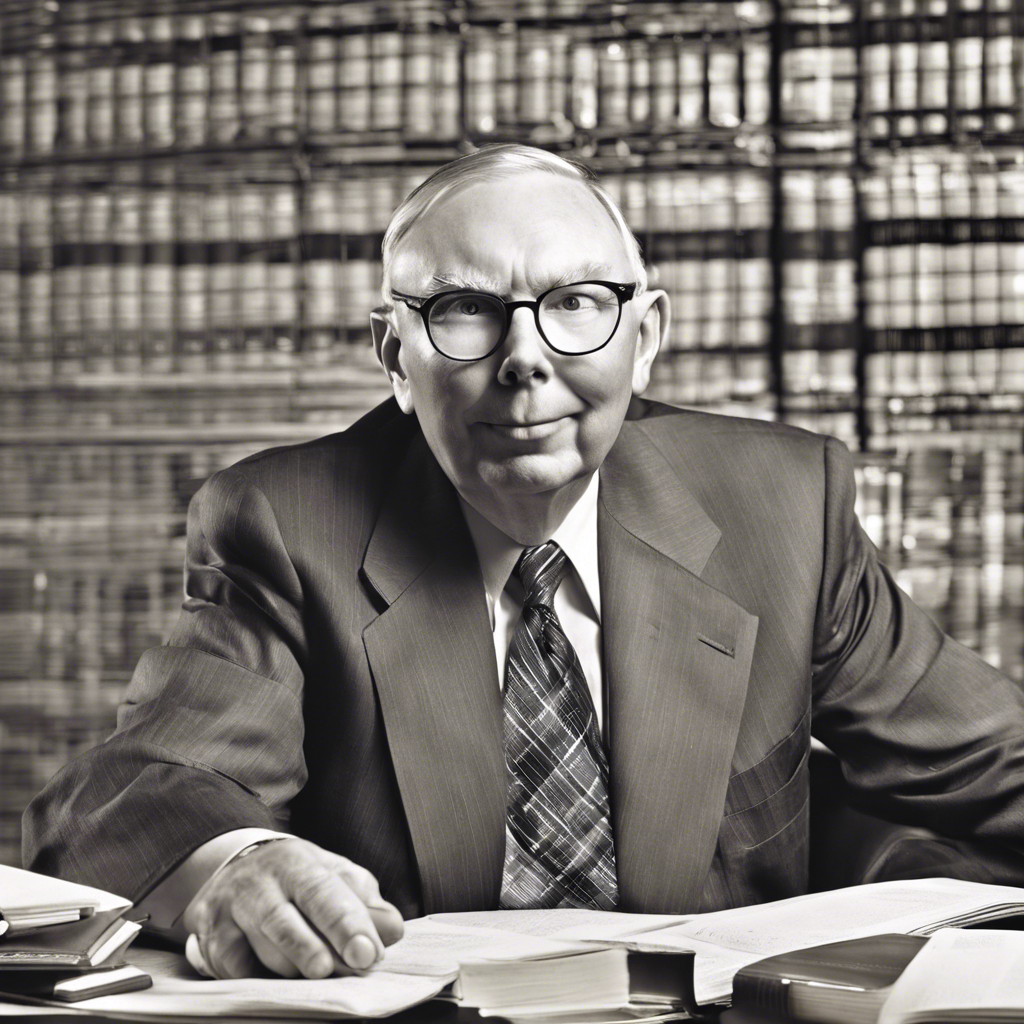

Remembering Charlie Munger: The Investing Sage Who Shaped Berkshire Hathaway

A look at the life and legacy of billionaire Charlie Munger, Warren Buffett’s right-hand man and key figure in the success of Berkshire Hathaway.

Billionaire investor Charlie Munger, renowned for his partnership with Warren Buffett and his instrumental role in the success of Berkshire Hathaway, has passed away at the age of 99. Munger’s influence on the world of investing and his unwavering commitment to value investing have left an indelible mark on the industry. This article delves into the life and achievements of Charlie Munger, exploring his early years, his partnership with Buffett, and his impact on the investment world.

A son of the heartland:

Born on January 1, 1924, in Omaha, Nebraska, Charles Thomas Munger grew up in a middle-class family. His early exposure to the world of business came through working at his grandfather’s grocery store, where he crossed paths with a young Warren Buffett. Munger’s journey took him to the University of Michigan and later to the California Institute of Technology, where he developed a passion for meteorology. It was during his time in California that Munger met his future wife, Nancy Huggins, and began his career in law.

The partnership that shaped an empire:

Munger’s path intersected with Warren Buffett’s in 1959 when he closed his late father’s legal practice and was introduced to the young investor by one of Buffett’s clients. The two immediately connected and discovered a shared investment philosophy rooted in value investing. Over the next six decades, Munger and Buffett built a close-knit partnership that would transform Berkshire Hathaway into one of the world’s most successful conglomerates. Their ability to think alike and complement each other’s strengths was a key factor in their enduring success.

The power of value investing:

Munger’s influence on Berkshire Hathaway and the investment world as a whole cannot be overstated. He was a steadfast advocate of value investing, a strategy that focuses on identifying undervalued stocks based on a company’s long-term fundamentals. Munger believed that intelligent investing meant acquiring assets for less than their intrinsic value, a principle that guided his decision-making throughout his career. His wisdom and insights played a crucial role in shaping Berkshire Hathaway’s investment strategy and contributed to its remarkable growth.

Navigating turbulent times:

During the 2020 coronavirus pandemic, Munger and Buffett took a conservative approach, prioritizing liquidity and caution over aggressive investments. This marked a departure from their strategy during the Great Recession, when they invested in distressed companies such as U.S. airlines and financial institutions. Munger’s pragmatic approach, emphasizing the importance of weathering storms and maintaining financial stability, reflected his long-term perspective and commitment to protecting Berkshire Hathaway’s shareholders.

A philanthropist and architect of change:

Beyond his investment prowess, Munger was also known for his philanthropy and commitment to making a positive impact on society. He was actively involved in various charitable endeavors and donated a significant portion of his wealth to causes he believed in. Munger’s contributions extended beyond the investment world, as he was also recognized for his architectural projects, including the development of real estate properties in California.

Conclusion:

Charlie Munger’s passing marks the end of an era in the world of investing. His partnership with Warren Buffett and his unwavering commitment to value investing have left an indelible mark on the industry. Munger’s wisdom, pragmatism, and philanthropic endeavors will continue to inspire future generations of investors and business leaders. As the investing world mourns the loss of a true legend, it is important to reflect on Munger’s enduring legacy and the lessons he imparted on the power of long-term thinking, prudent decision-making, and the pursuit of excellence.