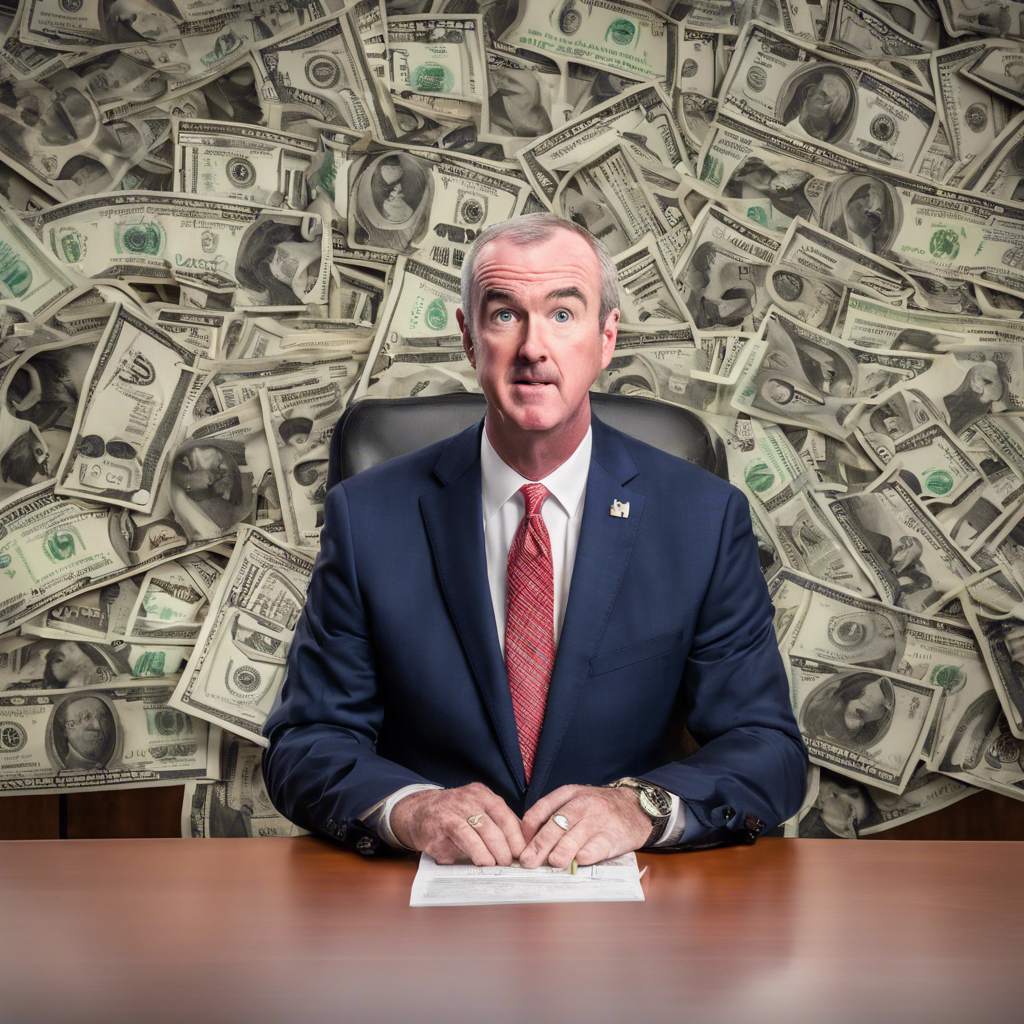

New Jersey Governor Phil Murphy Announces End to Corporate Business Tax Surcharge

Governor Murphy assures business group that the Corporate Business Tax surcharge will be eliminated as scheduled, despite calls for its continuation by left-wing coalition.

New Jersey Governor Phil Murphy addressed members of the New Jersey Business & Industry Association (NJBIA) on Tuesday, reaffirming his commitment to ending the Corporate Business Tax surcharge. The surcharge, which increased the state’s corporate tax rate by 2.5 percent in 2020, was intended to be temporary and is set to expire at the end of this year. Governor Murphy cited the state’s significant budget surplus and improved economic conditions as reasons for allowing the surcharge to sunset. However, a left-wing coalition called “For the Many” plans to rally in support of continuing the surcharge, arguing that its elimination would benefit only the wealthiest corporations.

The Corporate Business Tax Surcharge:

New Jersey’s corporate business tax is already one of the highest in the nation, with a maximum rate of 9 percent. The temporary surcharge, implemented in 2020, aimed to bridge the gap between challenging economic times and a more prosperous future. With the state’s current budget surplus of approximately $8 billion, Governor Murphy believes that the need for the surcharge has diminished. While he acknowledged the potential impact on the budget’s structural deficits, he expressed confidence in the state’s ability to navigate this challenge.

The Politics of the Surcharge:

Governor Murphy, known for his liberal stance on many issues, finds himself at odds with the left-wing coalition “For the Many” on this particular matter. The coalition argues that eliminating the surcharge would amount to tax cuts for the wealthiest corporations. Despite his alignment with the coalition’s ideology, Governor Murphy appears committed to honoring the agreement made three years ago. The extent of opposition he may face from his left flank remains uncertain.

Governor Murphy’s Vision for New Jersey:

During his tenure, Governor Murphy has focused on making New Jersey “stronger and fairer,” with an emphasis on balancing economic development, worker protection, and environmental preservation. He highlighted the state’s achievements in areas such as education and healthcare, which have received high ratings. The upcoming increase in the minimum wage to approximately $15 per hour is another accomplishment the governor mentioned. He also acknowledged the challenge of providing more affordable housing in a state where the average home costs half a million dollars. The governor stressed the importance of attracting and retaining residents, as New Jersey’s population has grown by nearly 500,000 people from 2010 to 2020.

Challenges and Optimism:

Governor Murphy also addressed recent setbacks, such as a Dutch company’s decision to abandon plans for offshore wind turbines off the Jersey coast. He referred to this as a “bump in the road” and expressed confidence in the future success of the offshore wind industry in New Jersey. Overall, he remains optimistic about the state’s prospects, drawing on his background in finance to predict a positive outlook for New Jersey in the medium to long term.

Conclusion:

Governor Phil Murphy’s announcement to end the Corporate Business Tax surcharge has garnered support from the business community, while a left-wing coalition continues to advocate for its continuation. As New Jersey experiences economic growth and a significant budget surplus, the governor believes it is time to let the surcharge sunset. Despite potential opposition from his liberal allies, Murphy remains committed to honoring the agreement made three years ago. With a focus on creating a stronger and fairer New Jersey, the governor highlighted achievements in education, healthcare, and small business development. Challenges such as the cost of living and affordable housing remain, but Murphy maintains a positive outlook for the state’s future.