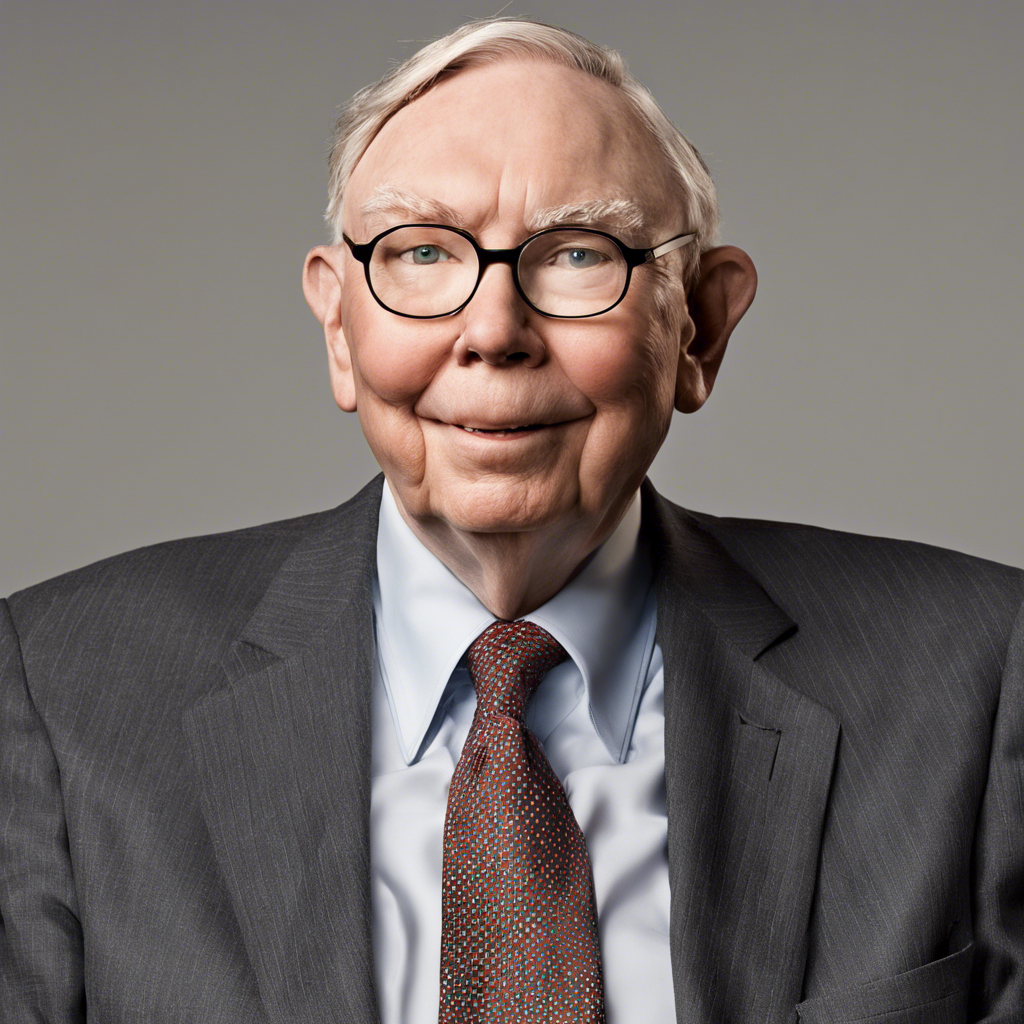

Remembering Charlie Munger: The Legacy of Warren Buffett’s Right-Hand Man

Billionaire investor Charlie Munger, known for his role as Warren Buffett’s trusted partner, passes away at age 99, leaving behind a profound legacy in the world of finance and beyond.

Charlie Munger, the esteemed vice chairman of Berkshire Hathaway and legendary investor, has passed away at the age of 99. Munger’s influence on the world of finance, as well as his contributions to various industries and philanthropic endeavors, cannot be overstated. As Warren Buffett’s right-hand man, Munger played a pivotal role in shaping the investment strategy and success of Berkshire Hathaway. This article pays tribute to Munger’s remarkable life and examines his enduring impact on the world.

1: The Journey of a Visionary Investor

Born in Omaha, Nebraska, on January 1, 1924, Munger’s early years laid the foundation for his future success. Munger’s partnership with Buffett began in 1959 when they were introduced by a mutual acquaintance. Despite living far apart, their shared values and investment philosophy forged a bond that would last nearly six decades. Munger’s keen intellect and ability to think independently made him an invaluable partner to Buffett, with the two often described as thinking alike.

2: The Architect of a New Investment Strategy

Munger’s influence on Buffett’s investment strategy cannot be overstated. He played a pivotal role in shifting Berkshire Hathaway’s focus from troubled companies to higher-quality, undervalued businesses. Munger’s ability to identify long-term value in companies such as See’s Candies showcased his astute investment acumen. His emphasis on acquiring businesses with strong fundamentals rather than settling for mediocre companies at cheap prices revolutionized Buffett’s approach to investing.

3: The Philosopher of Investing

Munger’s wisdom extended beyond the realm of finance. He was known for his insightful and often humorous commentary on life and investing. His belief in the “lollapalooza effect,” where multiple factors converge to influence investment psychology, demonstrated his deep understanding of human behavior and its impact on markets. Munger’s ability to distill complex concepts into simple, memorable phrases made him a revered figure in the investing community.

4: The Philanthropist’s Legacy

Munger’s philanthropic endeavors were as remarkable as his investment prowess. He believed in the moral duty to help others and dedicated his resources to various causes. Munger’s contributions to education, particularly at the University of Michigan and Stanford University, have left a lasting impact on future generations. His commitment to giving back and improving society exemplifies the true essence of his character.

5: A Lasting Legacy

Charlie Munger’s passing marks the end of an era in the world of investing. His remarkable partnership with Warren Buffett and his invaluable contributions to Berkshire Hathaway have solidified his place in financial history. Munger’s wisdom, integrity, and unique perspective on investing will continue to inspire generations of investors to come. His legacy serves as a reminder that success is not solely measured by wealth but by the impact one has on others and the world at large.

Conclusion: Charlie Munger’s passing is a profound loss for the investment community and beyond. His remarkable journey from a small-town boy to one of the most influential investors of our time is a testament to the power of dedication, intellect, and integrity. Munger’s contributions to the world of finance, his philanthropic endeavors, and his timeless wisdom will continue to shape the way we think about investing and life itself. As we bid farewell to this visionary investor, let us remember his legacy and strive to embody the principles he held dear.