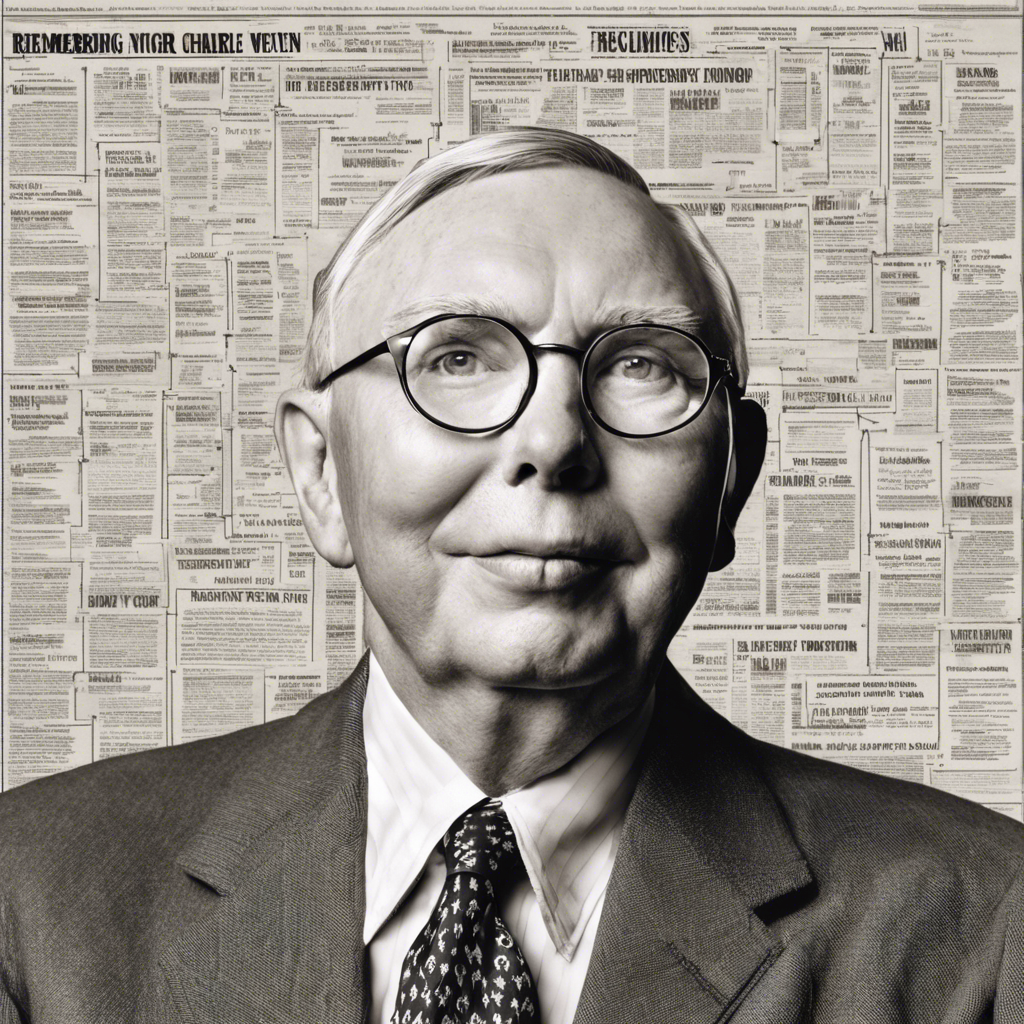

Remembering Charlie Munger: The Wise Words of a Legendary Investor

A look back at the life and wisdom of Charlie Munger, the renowned investor and vice chairman of Berkshire Hathaway.

The investment world mourns the loss of Charlie Munger, the esteemed investor and vice chairman of Berkshire Hathaway, who passed away at the age of 99. Munger, alongside his business partner Warren Buffett, led Berkshire Hathaway to incredible success over the years. As we reflect on Munger’s life and career, we delve into his invaluable insights and timeless wisdom, which have left an indelible mark on the investing community.

The Journey of a Billionaire Business Partner

Munger and Buffett, both hailing from Omaha, Nebraska, formed a formidable duo that propelled Berkshire Hathaway to new heights. Their partnership spanned decades, and together they navigated the ever-changing landscape of the investment world. Munger’s role as vice chairman of Berkshire Hathaway allowed him to contribute significantly to the company’s strategy and decision-making.

Selling Shares and Leaving a Legacy

In recent years, Munger made headlines for selling or donating a significant portion of his shares in Berkshire Hathaway, reducing his stake to just 25%. Despite this, his net worth remained substantial, estimated at $2.6 billion by Forbes. Munger’s decision to divest his shares was driven by a desire to leave a lasting impact rather than amassing personal wealth.

The Wisdom of Charlie Munger

Throughout his life, Munger shared his wisdom through memorable quotes and insights. Let’s explore some of his most profound teachings:

1. Betting Heavily on Your Best Bets:

Munger emphasized the importance of betting heavily on your best ideas when you have a clear edge. He believed that business schools often fail to teach this crucial lesson, leading many investors astray.

2. Surrounding Yourself with the Right People:

Munger advocated for removing toxic individuals from your life and surrounding yourself with reliable and trustworthy people. He believed that the company you keep plays a significant role in your success.

3. The Rarity of Success:

Munger acknowledged that true success is rare and elusive. He cautioned against overconfidence, highlighting the need for intelligence, hard work, and a stroke of good luck to achieve extraordinary results.

4. The Value of Continuous Learning:

Munger emphasized the importance of reading and learning throughout one’s life. He believed that wisdom comes from a constant thirst for knowledge and a commitment to lifelong learning.

5. The Limitations of Isolated Facts:

Munger stressed that true understanding cannot be achieved by memorizing isolated facts. Instead, he encouraged a holistic approach to learning, connecting ideas and concepts to gain a deeper understanding.

The Game of Life and Everlasting Learning

Munger viewed life as a game of perpetual learning. He believed that continuous growth and improvement were essential to achieving success in any endeavor. Munger’s philosophy advocated for embracing challenges and seeking wisdom in all aspects of life.

Avoiding Sloth and Unreliability

Munger emphasized the importance of avoiding laziness and unreliability. He believed that consistent effort and reliability were crucial for long-term success. By faithfully fulfilling commitments and avoiding laziness, individuals could set themselves up for success.

Conclusion:

Charlie Munger’s legacy extends far beyond his role as an investor. His wisdom and insights have inspired countless individuals to approach life and investing with a thoughtful and disciplined mindset. Munger’s teachings on betting heavily on your best ideas, surrounding yourself with the right people, and embracing continuous learning serve as guiding principles for aspiring investors and individuals seeking personal growth. As we remember Charlie Munger, we are reminded of the profound impact one person can have on an entire industry and the world.