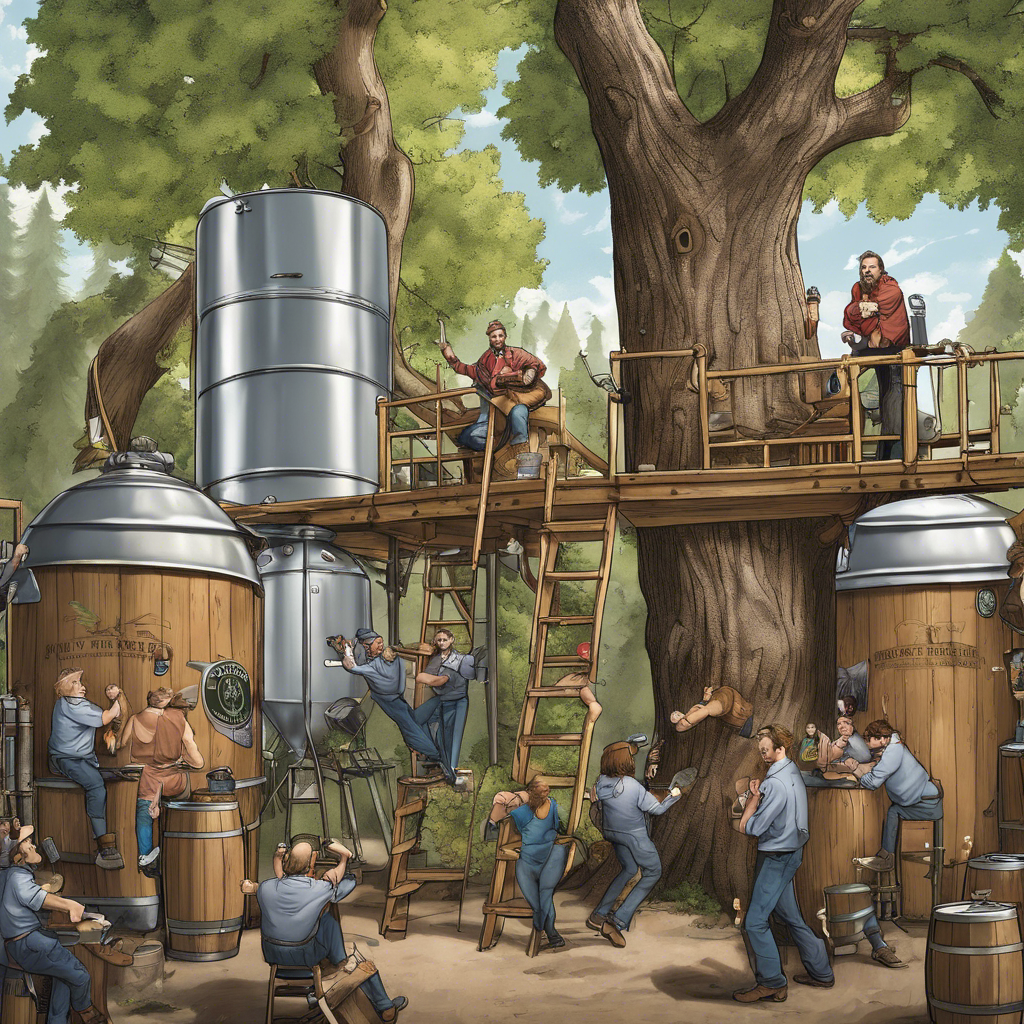

Power Struggle Brews Among Shareholders of Tree House Brewing Co.

Lawsuit reveals allegations of mistreatment and financial impropriety at popular craft beer company

A lawsuit filed in Hampden Superior Court has shed light on a power struggle among the shareholders of Tree House Brewing Co., a renowned craft beer company based in Charlton, Massachusetts. The civil complaint accuses the two majority owners, CEO Nathan P. Lanier and president Damien L. Goudreau, of prioritizing their own interests over those of minority shareholders. The lawsuit alleges excessive compensation, concealed real estate purchases, and the withholding of dividends. This legal battle raises questions about the treatment of minority shareholders and the fiduciary responsibilities of company executives.

A Pattern of Mistreatment

Eric Granger, a 2 percent owner and the last remaining minority shareholder at Tree House Brewing Co., initiated the lawsuit, claiming mistreatment by the majority owners. Granger’s attorney, Geoffrey Farrington, argues that the case demonstrates a larger pattern of mistreatment towards minority shareholders. Four other small shareholders have left the company in recent years, leaving Lanier and Goudreau with a combined 98 percent stake. The lawsuit alleges that the majority shareholders paid themselves excessively and engaged in questionable financial practices.

Special Considerations for Closely Held Companies

While shareholder lawsuits are common in large, publicly traded companies, the dynamics change in closely held companies like Tree House Brewing Co. Massachusetts law treats joint ownership of such companies as a “partnership,” which imposes a duty of utmost good faith and loyalty among partners and shareholders. Boston College law professor Brian Quinn explains that claims like Granger’s, which involve allegations of excessive compensation and personal purchases, are typically weak. However, the lawsuit may compel the executives to justify their decisions and demonstrate their benefit to the company.

Allegations of Financial Impropriety

The lawsuit raises concerns about Lanier and Goudreau’s financial decisions, particularly the creation of two LLCs through which they purchased $13 million worth of real estate without Granger’s knowledge. The holdings, including land in Charlton and a beachfront home in Sandwich, were only disclosed after Granger sent a demand letter in September 2022. Pierluigi Matera, a corporate law scholar and Boston University professor, suggests that the company will need to prove the fairness of these transactions if the case goes to trial. Failure to do so could indicate a breach of fiduciary duty by the majority shareholders.

Deprivation of Financial Benefits

The lawsuit also alleges that Granger and other former minority shareholders were deprived of enjoying any significant financial benefits from their ownership stake. While large publicly traded companies often reinvest profits rather than paying dividends, Tree House Brewing Co.’s small number of shareholders, including Granger, must pay taxes on their share of the company’s profits. Suffolk University Law School professor Jeff Lipshaw argues that the failure to pay sufficient dividends to cover these taxes is a classic technique of minority oppression.

Implications for a Massachusetts Success Story

The outcome of this lawsuit could have significant implications for Tree House Brewing Co., which has achieved success as a small business in Massachusetts. Since its launch in 2011, the company has gained widespread acclaim for its unique direct-to-consumer model and its high-quality craft beers. Adam Romanow, president of the Massachusetts Brewers Guild, acknowledges Tree House’s success and emphasizes the importance of fair treatment for all shareholders. The lawsuit’s protracted nature and allegations of mistreatment raise concerns about the potential impact on the company’s reputation and future growth.

Conclusion: The lawsuit among the shareholders of Tree House Brewing Co. highlights the challenges and complexities that can arise in closely held companies. The allegations of mistreatment, financial impropriety, and deprivation of financial benefits raise important questions about the fiduciary responsibilities of majority shareholders and the rights of minority owners. As this legal battle unfolds, it will test the company’s ability to defend its actions and address the concerns of its shareholders. The outcome will have implications not only for Tree House Brewing Co. but also for the broader craft beer industry and the treatment of minority shareholders in privately held companies.